New paycheck calculator

Why Gusto Payroll and more Payroll. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How Your New Hampshire Paycheck Works Even in a state like New Hampshire that does not levy income tax on wages workers still have to pay federal income taxes.

. A financial advisor in South Carolina can help you understand how taxes fit into your overall financial goals. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. Switch to New York hourly calculator.

How You Can Affect Your South Carolina Paycheck. This calculator is intended for use by US. The calculator is updated with the tax rates of all Canadian provinces and territories.

The income tax rate ranges from 4 to 109. You can use the calculator to compare your salaries between 2017 and 2022. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

Federal income taxes are also withheld from each of your paychecks. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. The amount can be hourly daily weekly monthly or even annual earnings.

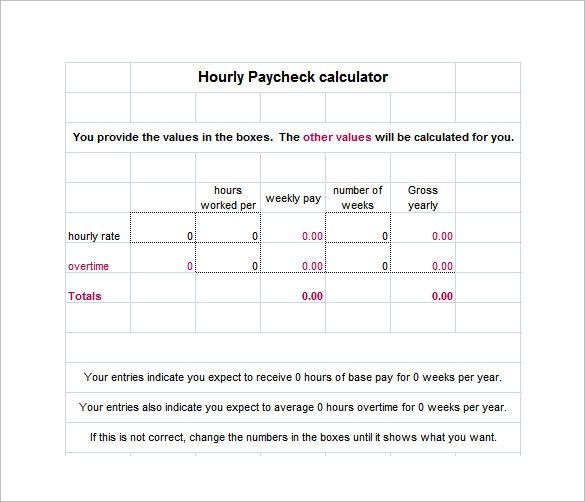

Calculate your paycheck withholdings for free. This Ohio hourly paycheck calculator is perfect for those who are paid on an hourly basis. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees.

WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help taxpayers check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act in December. Usage of the Payroll Calculator. Figure out your filing status.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable. Calculating your Arkansas state income tax is similar to the steps we listed on our Federal paycheck calculator. One way you can affect your take-home.

Automatic deductions and filings direct deposits W-2s and 1099s. There are two paycheck calculators that compute paychecks for employees in Illinois and New York. Overview of Michigan Taxes Michigan is a flat-tax state that levies a state income tax of 425.

Important note on the salary paycheck calculator. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major change since 1987. Paycheck calculators Payroll tax rates Withholding forms Small business guides new.

If you want to tweak your paycheck you can do so. Texas Salary Paycheck Calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The IRS urges taxpayers to use these tools to make sure they have the right. How Your Ohio Paycheck Works. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimatesIt should not be relied upon to calculate exact taxes payroll or other financial data.

Most importantly it removes the use of allowances and instead features a five-step process that. Figure out your filing status. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Texas.

If you have questions about Americans with Disabilities Act Standards for Accessible Design please contact 916 372-7200 or PPSDWebmasterscocagov. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck calculator. Several factors - like your marital status salary and additional tax withholdings - play a role in how much is taken out.

Being the fourth most populous US state New York state has a population of over 20 million 2021 and is known for its diverse geography melting pot culture and the largest city in America New York CityThe median household income is 64894 2017. How much you pay in federal income taxes depends on several factors including your salary your marital status and whether you elect to have additional tax withheld from your paycheck. Maryland state has a population of a little over 6 million 2019 and is a major historic trading port and birthplace of the national anthem.

Results provided by Payroll Calculator are of a general nature. How Your New Jersey Paycheck Works. Overview of Utah Taxes.

The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding. Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New York paycheck calculator. Then enter the employees gross salary amount.

Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator. You need to report new hires to the Texas Attorney Generals office. Enter your pay rate.

Calculating your paychecks is tough to do without a paycheck calculator because your employer withholds multiple taxes from your pay. Need help calculating paychecks. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

Financial advisors can also help with investing and financial planning - including retirement homeownership insurance and more - to make sure you are preparing for the future. These calculators are not intended to provide tax or legal advice and do not represent any. A financial advisor in Washington DC.

Its median household income is also among the highest in America at 80776 2017. You must do this within 20 days. Hourly Paycheck and Payroll Calculator.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The California DE-4 forms tells your employer how many allowances youre claiming and how much to. The new W-4 comes with significant revisions.

How You Can Affect Your DC. Can help you understand how taxes fit into your overall financial goals. Has a tax benefit recapture supplemental tax.

If your paychecks seem small and you get a big tax refund every year you might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. IR-2018-36 February 28 2018. This New York hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Sponsored Links Sponsored Links Payroll Information Paycheck Gross Pay. Exempt means the employee does not receive overtime pay.

No liability will be accepted for the outcome.

Net Pay Definition And How To Calculate Business Terms

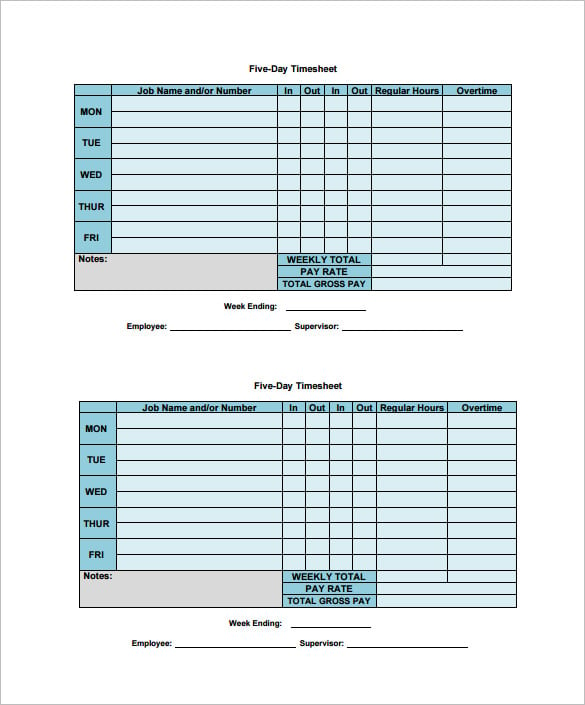

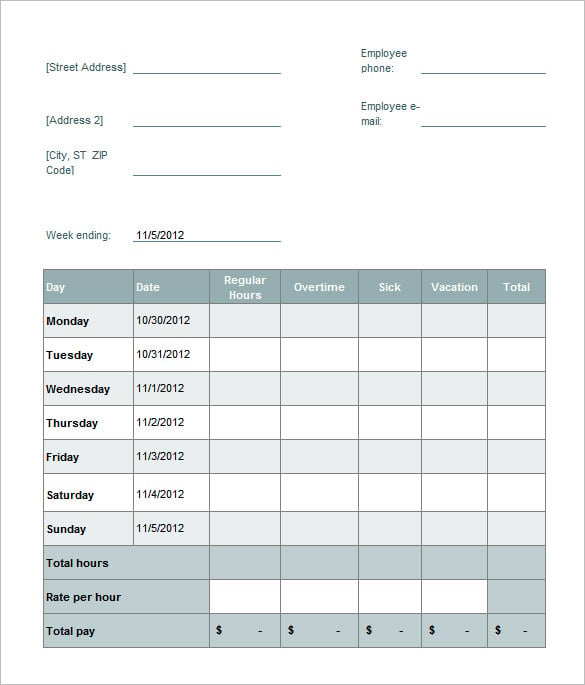

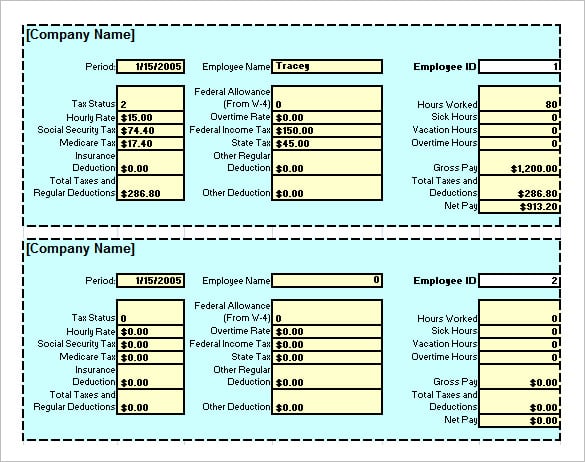

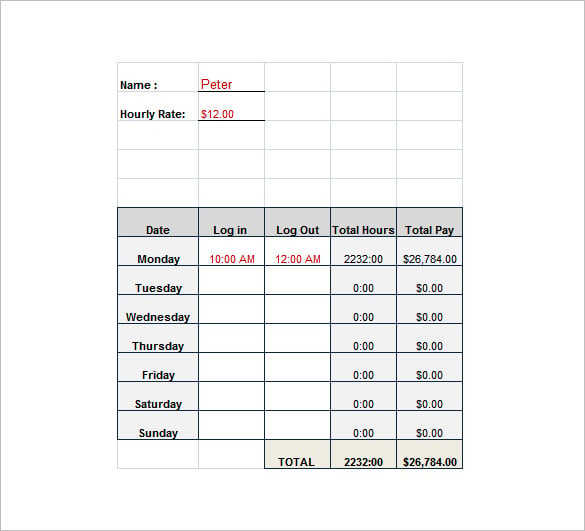

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator Online For Per Pay Period Create W 4

Gross Pay And Net Pay What S The Difference Paycheckcity

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Ready To Use Paycheck Calculator Excel Template Msofficegeek

1wxmydejhzto9m

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator Us Apps On Google Play

Paycheck Calculator Take Home Pay Calculator

Pennsylvania Paycheck Calculator Smartasset

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Komentar

Posting Komentar